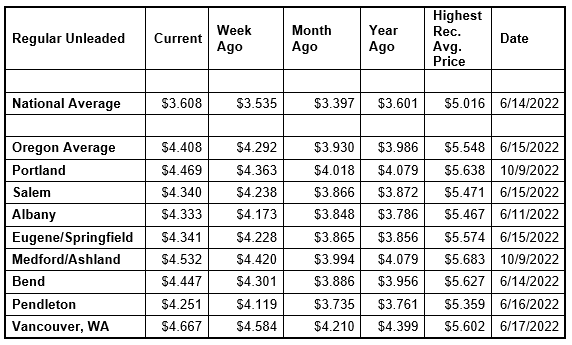

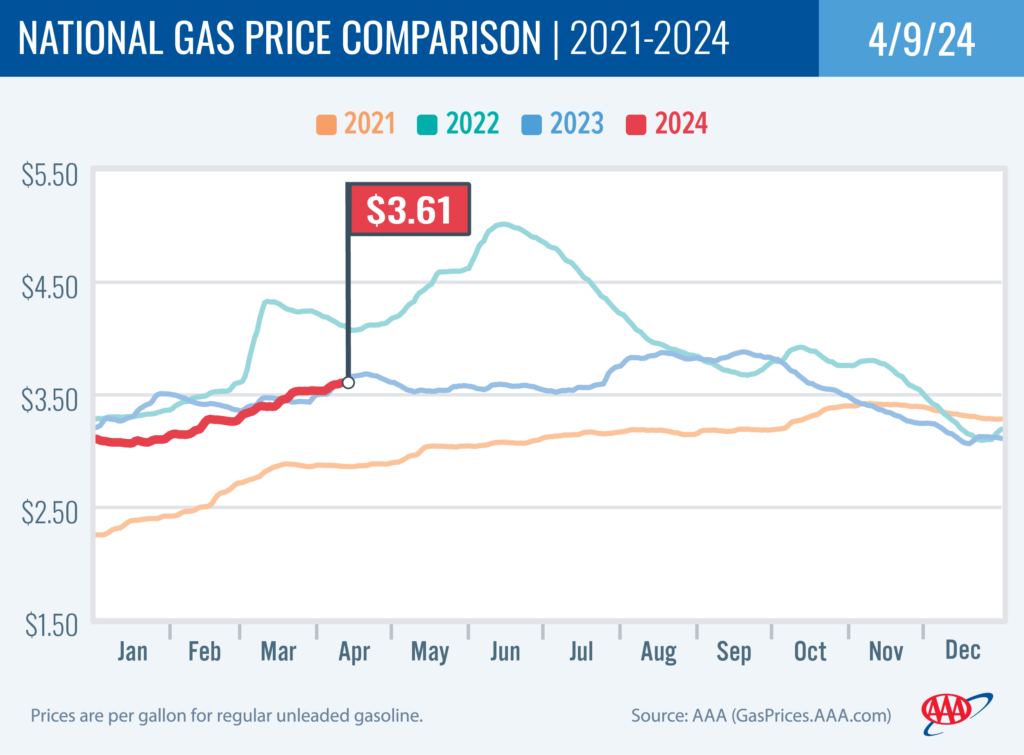

PORTLAND, Ore., – Gas prices are climbing in most states, including Oregon, this week due to crude oil prices holding at six-month highs as well as refinery maintenance, especially on the West Coast. Crude oil prices have remained above $85 per barrel since April 2, mostly due to geo-political issues in the Middle East as well as drone strikes on Russian refineries. For the week, the national average for regular adds seven cents to $3.61. The Oregon average soars 12 cents to $4.41 a gallon. This is the ninth-largest weekly jump for a state in the nation.

Refinery maintenance is impacting at least three refineries in California: Chevron El Segundo in the Los Angeles area, Chevron Richmond in the San Francisco area, and PBF Martinez in the San Francisco area. The reduction in supplies is causing gas prices to soar on the West Coast, especially in Arizona (+27 cents week-over-week) and California (+25 cents week-over-week).

“We’re seeing significant refinery maintenance on the West Coast. The seasonal factors of refinery maintenance, the switch to summer-blend fuel and the increase in demand for gas are all at play, resulting in climbing pump prices,” says Marie Dodds, public affairs director for AAA Oregon/Idaho. “In addition, higher crude oil prices are also putting upward pressure on pump prices.”

The national and Oregon averages are at their highest prices since October.

Only two Oregon counties still have averages below $4 a gallon:

Baker $3.95

Malheur $3.98

The Oregon average began 2024 at $3.79 a gallon compared to $4.41 today. Its lowest price so far this year is $3.58 on February 14 and it has been steadily climbing since then. The national average started the year at $3.11 and is at $3.61 today. Its lowest price so far this year is just under $3.07 on January 15.

Gas prices always rise this time of year as refineries undergo maintenance as the switch to summer-blend fuel occurs. The switch occurs first in California, which is why pump prices on the West Coast often rise before other parts of the country. The East Coast is the last major market to switch to summer-blend fuel. Most areas have a May 1 compliance date for refiners and terminals, while most gas stations have a June 1 deadline to switch to selling summer-blend until June 1. Switch-over dates are earlier in California with some areas in the state requiring summer-blend fuel by April 1. Some refineries will begin maintenance and the switchover in February.

Crude oil prices have remained elevated due to geopolitical events around the world including increased volatility in the Middle East, drone attacks on Russian refineries, and Houthi militant attacks in the Red Sea. In addition, production cuts by OPEC+ has tightened global crude oil supplies.

Crude oil prices are at their highest since October. West Texas Intermediate climbed above $80 on March 14 and above $85 on April 2. A major driver is the Ukrainian attacks on Russian refineries. Russia is a top global oil producer and the refinery attacks have reduced output.

Crude prices were volatile after the attack on Israel by Hamas in October. While Israel and the Palestinian territory are not oil producers, there’ve been concerns that the conflict could spread in the Middle East, which could potentially impact crude production in other oil-producing nations in the region.

Crude oil is trading around $85 today compared to $85 a week ago and $80 a year ago. In 2023, West Texas Intermediate ranged between $63 and $95 per barrel. Crude reached recent highs of $123.70 on March 8, 2022, shortly after the Russian invasion of Ukraine, and $122.11 per barrel on June 8, 2022. The all-time high for WTI crude oil is $147.27 in July 2008.

Crude oil is the main ingredient in gasoline and diesel, so pump prices are impacted by crude prices on the global markets. On average, about 57% of what we pay for in a gallon of gasoline is for the price of crude oil, 14% is refining, 13% distribution and marketing, and 16% are taxes, according to the U.S. Energy Information Administration.

Demand for gas in the U.S. rose from 8.72 to 9.23 million b/d for the week ending March 29, according to the U.S. Energy Information Administration (EIA). This compares to 9.30 million b/d at the same time last year. Meanwhile, total domestic gasoline stocks decreased by 4.2 million bbl to 227.8 million bbl.

Higher demand and rising oil prices will likely nudge pump prices higher.

Quick stats

Oregon is one of 46 states and the District of Columbia with higher prices now than a week ago. Indiana (+28 cents) has the largest week-over-week gain in the nation. Arizona (+27 cents) and California (+25 cents) have the second- and third-largest weekly jumps. Oregon has the ninth-largest increase. Michigan (-7 cents) has the biggest weekly decline.

California ($5.37) has the most expensive gas in the nation for the sixth week in a row and is the only state in the nation with an average at or above $5 per gallon. Hawaii ($4.72) is second, Washington ($4.64) is third, Nevada ($4.58) is fourth, Oregon ($4.41) is fifth, Alaska ($4.25) is sixth, and Arizona ($4.07) is seventh. These are the seven states with averages at or above $4, up from six states a week ago. This week 43 states and the District of Columbia have averages in the $3-range. No states have averages in the $2 range this week.

The cheapest gas in the nation is in Colorado ($3.07) and Mississippi ($3.11). No state has had an average below $2 a gallon since January 7, 2021, when Mississippi and Texas were below that threshold.

The difference between the most expensive and least expensive states is $2.31 this week, compared to $2.05 a week ago.

Oregon is one of 49 states and the District of Columbia with higher prices now than a month ago. The national average is 21 cents more and the Oregon average is 48 cents more than a month ago. This is the sixth-largest monthly gain in the nation. Utah (+64 cents) has the largest monthly jump. Michigan (-4 cents) is the only state with a month-over-month decline.

Oregon is one of 20 states and the District of Columbia with higher prices now than a year ago. The national average is one cent more and the Oregon average is 42 cents more than a year ago. This is the second-largest yearly gain in the nation. California (+49 cents) has the largest year-over-year increase. Colorado (-39 cents) has the largest yearly decrease.

West Coast

The West Coast region continues to have the most expensive pump prices in the nation with all seven states in the top 10. It’s typical for the West Coast to have six or seven states in the top 10 as this region tends to consistently have fairly tight supplies, consuming about as much gasoline as is produced. In addition, this region is located relatively far from parts of the country where oil drilling, production and refining occurs, so transportation costs are higher. And environmental programs in this region add to the cost of production, storage and distribution.

| Rank | Region | Price on 4/9/2024 |

| 1 | California | $5.37 |

| 2 | Hawaii | $4.72 |

| 3 | Washington | $4.64 |

| 4 | Nevada | $4.58 |

| 5 | Oregon | $4.41 |

| 6 | Alaska | $4.25 |

| 7 | Arizona | $4.07 |

| 8 | Illinois | $4.00 |

| 9 | Utah | $3.88 |

| 10 | Idaho | $3.83 |

As mentioned above, California has the most expensive gas in the country for the sixth week in a row. Hawaii, Washington, Nevada, Oregon, Alaska and Arizona round out the top seven. Oregon is fifth most expensive for the 25th week in a row.

All seven states in the West Coast region are seeing week-over-week increases: Arizona (+27 cents), California (+25 cents), Nevada (+12 cents), Oregon (+12 cents), Alaska (+11 cents), Washington (+10 cents), and Hawaii (+3 cents).

The refinery utilization rate on the West Coast fell from 84.5% to 83.8% for the week ending March 29. This rate has ranged between about 74% to 97% in the last year. The latest national refinery utilization rate decreased slightly from 88.7% to 88.6%. The refinery utilization rate measures how much crude oil refineries are processing as a percentage of their maximum capacity. A low or declining rate can put upward pressure on pump prices.

According to EIA’s latest weekly report, total gas stocks in the region fell from 29.49 million bbl. to 29.05 million bbl.

An decrease in the refinery utilization rate and/or a low rate can put upward pressure on pump prices while a decrease in gasoline stocks can put upward pressure on pump prices.

Oil market dynamics

Crude oil prices climbed last week driven by rising tensions in the Middle East and concerns that a conflict in the region could impact crude production. So far this week, crude oil prices have steadied after Israel cut its troop presence in Gaza. Also, the EIA reported an increase of 3.2 million barrels from the previous week. At 451.4 million barrels, U.S. crude oil inventories are about 2% below the five-year average for this time of year.

At the close of Friday’s formal trading session, WTI gained $1.76 to settle at $86.91. At the close of Monday’s formal trading session, WTI lost 92 cents to close at $85.99. Today crude is trading around $85 compared to $85 a week ago. Crude prices are about $6 more than a year ago.

Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.

Diesel

For the week, the national average adds three cents to $4.05 a gallon. The record high is $5.816 set on June 19, 2022. The Oregon average rises four cents to $4.27. The record high is $6.47 set on July 3, 2022. A year ago the national average for diesel was $4.21 and the Oregon average was $4.60.

Find current fuel prices at GasPrices.AAA.com.

AAA news releases, high resolution images, broadcast-quality video, fact sheets and podcasts are available on the AAA NewsRoom at NewsRoom.AAA.com.

Find local news releases at https://oregon.aaa.com/community/media/media-contacts.html

Fuel prices are updated daily at AAA’s Daily Fuel Gauge at AAA Gas Prices. For more info go www.AAA.com. AAA Oregon/Idaho provides more than 890,000 members with travel, insurance, financial and automotive-related services, and is an affiliate of AAA National, serving more than 64 million motorists in North America.