AAA Says, Prepare by Understanding What Your Insurance May Cover

From frozen pipes and fallen trees to caved-in roofs and broken windows, storms can wreak havoc on your home and automobiles. AAA suggests that homeowners and renters check their insurance policies to see what is covered.

“When high winds begin to howl or layers of ice and snow coat roofs and roads, knowing what your insurance may cover can help you rest easier,” said Bob Sadler, Director of Insurance at AAA Oregon/Idaho. “Understanding your policy will also help you plan any precautions that need to be taken.”

Here are a few of the types of winter storm damages your AAA policy may cover.

- Wind Damage. Wind storm damage to your home, its roof, and other insured buildings on your property, such as a stand-alone garage, will be covered under your standard homeowners policy. Cars damaged by wind will be covered under the comprehensive portion of your auto policy.

- Rain Damage. If a storm smashes a window in your home, or puts a hole in your home allowing rain to pour in, the water damage it causes to your home’s interior or possessions may be covered.

- Frozen Pipes. The damage caused by burst frozen pipes, whether it’s destroyed furniture or electronic items, is normally covered. The cost to access and repair the pipe, including a torn out wall, may also be covered. However, damage may only be covered if the heat was on in your home at the time. Check your policy.

- Snow Pileup. The weight of snow on a rooftop that accumulates during a severe snowstorm can cause the roof to cave in. The structural damage to the roof and any water damage to the interior of the home may be covered under a homeowners policy.

- Ice Dams. Your policy may cover destruction from ice dams, which form in gutters as a result of snow melting and refreezing. The damage can include broken gutters and windows, as well as damage to the sides of your home. Water from melting snow that is unable to drain into blocked gutters may seep through the roof and cause damage to the inside of your home or its possessions, which may also be covered.

- Falling Trees. Trees crashing down onto the roof of your home, another insured building on your property, or a fence can cause damage that may be covered. Removal of the tree will also be covered up to a certain amount (some policies in California have exceptions), provided it hits a structure or blocks a driveway. It may not be covered if it just falls on the ground. The comprehensive portion of your auto policy could cover cars damaged by fallen trees or branches.

- Food Spoilage. In a power outage caused by a winter storm the contents of your refrigerator or freezer may spoil. This spoilage may be covered by your homeowners policy, but the amount could vary from state to state.

- Living Expenses. If your home is damaged so severely that you’re forced to live elsewhere, your homeowners policy may cover reasonable expenses while it is being repaired.

- Hail Damage. Hail does more damage in the U.S. than any other natural hazard, except marine storms and high winds. Your homeowners policy should cover hail storm damage to your house. Additionally, the comprehensive portion of your auto policy may cover cars damaged by hail.

Special limits and deductibles apply to some coverages. Your policy will have the details.

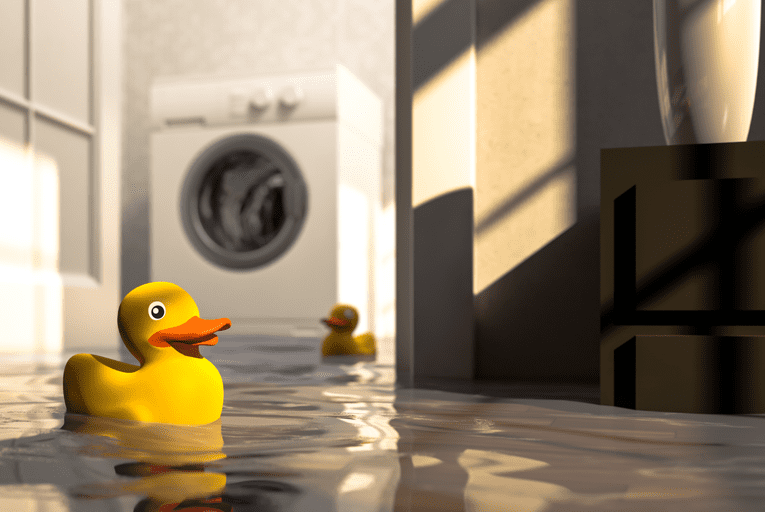

Remember though, standard homeowners insurance policies do not have flood coverage, and a separate flood policy is needed. AAA sells flood insurance policies underwritten by the National Flood Insurance Program managed by FEMA (Federal Emergency Management Agency). There have been important changes that have been made to the Flood Insurance Program. You should contact your AAA Insurance Professional to learn more. The comprehensive portion of your auto policy may cover flood damage to your vehicle.

Check with your local AAA Insurance Professional or visit AAA.com/Insurance for more information

AAA Oregon/Idaho is not an insurance company and offers insurance solely as an agent for other companies through its subsidiary, Automobile Association Agency. Further information as to those insurance companies will be provided upon request or when receiving an insurance quote. Discounts are subject to qualification and may vary by insurance company and type of insurance coverage. Call 1-866-AAA-QUOTE (1-866-222-7868) for a quote.