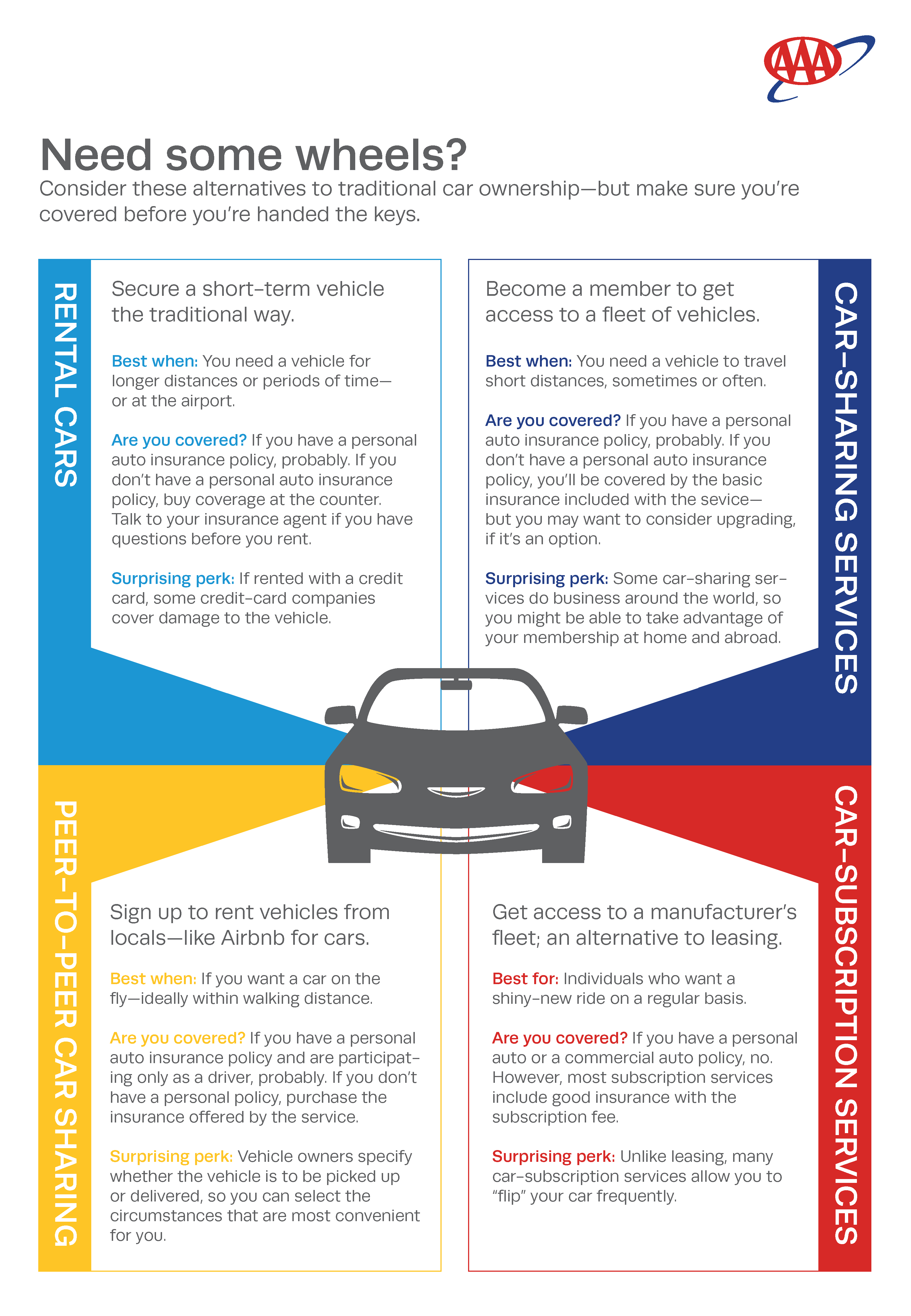

Consider these alternatives to car ownership—but make sure you’re covered before you’re handed the keys.

How do you get from here to there?

Gone are the days when your options were limited to car ownership, public transit or hailing a taxi. In today’s on-demand, always-connected world, there are more ways than ever to secure a ride or vehicle, whether you’re grabbing groceries, taking a road trip or vacationing far away.

But while modern conveniences like car-rental, car-sharing and car-subscription services are attractive, there are safety and insurance risks that come with participating. Here, we break down four alternatives to car ownership and what you need to know before you’ve handed over the keys.

Alternatives to Car Ownership

RENTING A CAR

Best when: You need a vehicle for longer distances or periods of time—or at the airport.

Are you covered? If you have a personal auto insurance policy, probably. If you don’t have a personal auto insurance policy, buy coverage at the counter. Talk to your insurance agent if you have questions before you rent.

Surprising perk: If rented with a credit card, some credit-card companies cover damage to the vehicle.

Car-rental companies are nothing new, but there’s no doubt that the car-rental industry is changing to be come a more appealing car ownership alternative. From finding ways to reduce their carbon footprint to incorporating smartphone technology into the customer experience, these traditional companies are striving to stay relevant in an evolving landscape. In fact, some of them are launching their own car-sharing programs, allowing them to tap into the trend of on-demand transportation.

Despite emerging car rental alternatives, however, there are times when traditional car rental may be your best bet—especially if you’re traveling in an area where on-demand services aren’t available. But are you covered when you rent a car the old-school way? The answer depends largely on whether or not you have a personal auto insurance policy, as well as the decisions you make at the rental counter.

Renting a Car: FAQ

Check with your insurance agent to make sure your policy covers you while you are driving another car—but you are likely covered throughout the United States. Ask your agent about your specific policy. Outside the U.S., you are only covered in Canada. You are not covered in other foreign countries, including Mexico.

It depends, so it’s important to understand what’s covered under your personal policy. Most rental-car companies offer four types of coverage:

Liability insurance: Your personal auto insurance policy includes liability coverage, so you probably don’t need to buy additional liability coverage at the counter. Many rental-car companies include the state required minimum amount of liability insurance with the cost of your car rental. However, this often does not provide enough protection, which is why it’s good if you also have a personal policy with higher liability limits.

A loss damage waiver: Also known as a collision damage waiver, this waives you of financial responsibility in case the rented vehicle is damaged or stolen. If your personal policy includes comprehensive and/or collision coverage, you probably don’t need the waiver. If your personal policy does not include comprehensive and/or collision coverage, you may want to consider the waiver.

Personal accident insurance: This covers you and your passengers in case there are injuries caused by an accident. Talk to your agent before purchasing this, as your personal auto policy may already cover medical expenses. If it doesn’t, you may want to purchase the coverage offered by the rental-car company.

Personal effects coverage: This covers you if belongings are stolen from your rental car. If you don’t have a homeowners or renters insurance policy, you may want to consider purchasing this coverage.

Basic liability coverage—which covers damage you do to another car and medical costs for those injured in an accident that you caused—is typically included in the cost of the rental. This often does not provide enough protection, though, so consider upgrading.

It’s up to you if you want to opt for the loss damage waiver, personal accident insurance or personal effects coverage, but generally, it’s a good idea. Otherwise, you could be on the hook financially if your rental is lost or stolen; if you or your passengers are injured in an accident; or if belongings are stolen from the vehicle.

If you’re paying with a credit card, do some research to find out if the credit-card company offers primary rental car coverage, which covers damage to the rental car. However, primary coverage does not cover injuries to others and their property—so you’ll still want the personal liability insurance offered by the rental-car company.

If you’re a frequent renter, you may want to consider non-owner’s car insurance, a low-cost option that’s ideal for individuals who don’t own a vehicle and only drive sometimes. For more information, talk to your insurance agent.

MEMBERSHIP-BASED CAR-SHARING SERVICES

Best when: You need a vehicle to travel short distances, sometimes or frequently.

Are you covered? If you have a personal auto insurance policy, probably. If you don’t have a personal auto insurance policy, you’ll be covered by the basic insurance included with the service—but you may want to consider upgrading, if it’s an option.

Surprising perk: Some car-sharing services do business around the world—so you might be able to take advantage of your membership at home and abroad.

Ever see bright logos on the sides of cars, zipping around the city? Or maybe you’ve scrolled past an ad for a service that’s leveraging technology to make renting a car as easy as possible.

Membership-based car-sharing services are rising in popularity, especially among urban dwellers who want wheels on-demand but can’t or don’t want to own a vehicle. While each service—many of which are subsidiaries of traditional car-rental companies—works slightly differently, the premise is the same: Once members are approved and pay a small fee, they are able to use vehicles for periods of time ranging from minutes to overnight. Some companies require reservations and designate pick-up and drop-off spots, whereas others simply park vehicles in allocated areas, making it possible for a driver to gain access with the swipe of a membership card. Members are billed each time they use a car.

Membership-based car-Sharing Services: FAQ

Check with your insurance agent to make sure your policy covers you while you are driving another car—but generally, yes, you are covered throughout the U.S and Canada.

Most car-sharing services that charge a monthly membership fee include liability coverage and personal injury protection up to the minimum limits required by the state. Because coverage levels may vary based on your geographic location, always do your homework before getting behind the wheel.

The vehicles themselves are usually covered under a comprehensive collision policy when driven by a member. That’s right, only when driven by a member, so don’t let your friends or family members drive! Some companies offer an additional damage fee waiver, which reduces or eliminates the amount you are responsible for paying if the vehicle is damaged. Deductibles usually range between $250 and $1,000.

If you don’t own a vehicle and frequently borrow from others or use a car-sharing service, you could consider purchasing a non-owner car insurance policy as an alternative to ensure you have the liability coverage you need. Talk to your insurance agent for more information.

PEER-TO-PEER CAR-SHARING SERVICES

Best when: If you want a car on the fly—ideally within walking distance.

Are you covered? If you have a personal auto insurance policy and drive a car from a peer-to-peer car-sharing service, probably. If you don’t have a personal auto insurance policy, purchase the insurance offered by the service.

Surprising perk: Owners specify whether the vehicle is to be picked up or delivered, so you can select the circumstances that are most convenient for you.

We can rent other peoples’ homes with a few clicks—so why not their vehicles, too? Peer-to-peer car-sharing—also known as one-to-one car-sharing or person-to-person car sharing—allows local people to rent their vehicles to each other in exchange for a fee, often via smartphone app.

These services are especially popular in urban areas, where car ownership can be come with challenges like finding regular parking. They also appeal to environmentally conscious individuals who want to see fewer cars on the road, as well as those who want the flexibility of choosing the cost and location of a vehicle. Rental fees are based on the type of car and its location.

Peer-to-peer car-sharing services: FAQ

Probably—but only if you’re participating as a driver. Most auto insurance policies are rendered null and void if you rent out your own vehicle, as it falls under commercial use. So, talk to your insurance agent before listing your car.

Because peer-to-peer sharing is rising in popularity, some insurers are starting to offer endorsements to personal auto insurance policies. However, many still require that you purchase a commercial policy. Before participating in a peer-to-peer car-sharing program, talk to your insurance agent.

You may need a commercial policy if you use you own a vehicle that you use to conduct your work. This includes transporting others for a fee, providing a service, or hauling tools and trailers. The nature of your work may also call for higher liability limits. Talk to your insurance agent for more information.

Most peer-to-peer car-sharing programs do not require that you have a personal or commercial auto policy. Instead, they offer different insurance packages with varying levels of liability and physical damage protection. Basic plans include only coverage for damages. Premium plans include comprehensive and collision coverage, medical expenses coverage and uninsured/underinsured motorist coverage.

Because some drivers may be covered by a personal or commercial auto policy, declining the program’s coverage altogether is an option. Talk to your insurance agent for more information about these car ownership alternatives.

CAR-SUBSCRIPTION SERVICES

Best for: Individuals who want a shiny-new ride all the time.

Are you covered? If you have a personal auto or a commercial auto policy, no. However, most subscription services include good insurance with the subscription fee.

Surprising perk: Unlike leasing, many car-subscription services allow you “flip” your car frequently.

Today, subscription services are all the rage. From do-it-yourself meals to personal styling services to on-demand media, there’s no shortage of customers who are willing to pay a monthly fee in exchange for access and perks. The car industry has caught on, too.

Car-subscription services, most backed by well-known car manufacturers, give users access to certain vehicles in exchange for a monthly fee. Like car-rental and car-sharing services, car-subscription services are an attractive option for those who are looking for alternatives to car ownership, specifically leasing. The services are especially appealing to tech-savvy drivers who like the gratification of getting new-to-them car regularly. Sometimes service even comes within minutes after the request.

Third-party car-subscription services that aren’t backed by vehicle manufactures are also popping up. Most of these services offer used vehicles at a wider range of pricing.

Car-Subscription Services: FAQ

Probably not. Most insurance companies don’t provide coverage for car subscriptions.

Insurance protection is likely included in the subscription agreement. Review the agreement closely before you sign up.

In short: pretty good insurance. Vehicles from a car-subscription service are generally owned by an operator that has commercial auto insurance for the entire fleet.

This coverage is typically included in the subscription package and includes basic liability coverage plus personal injury protection, medical payment coverage, comprehensive coverage, collision coverage and uninsured/underinsured motorist coverage. Maintenance is also often included with the monthly membership fee—so you can drive worry-free.

More Information on Car Ownership Alternatives

For more information about the insurance and car ownership alternatives, talk to your AAA Insurance Professional.