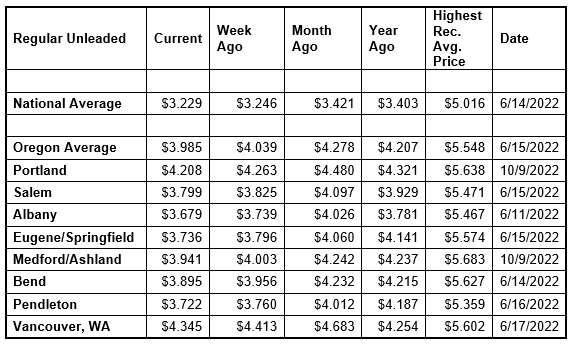

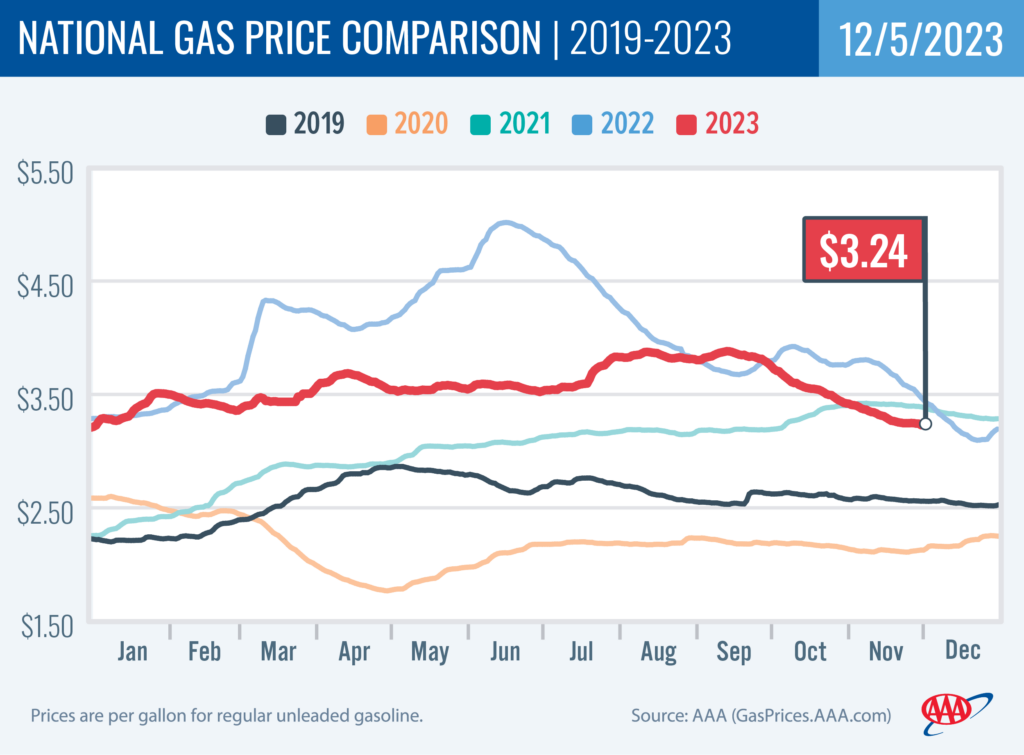

PORTLAND, Ore., – Drivers continue to enjoy savings at the pumps with gas prices moving lower in most states. The Oregon average has dipped below $4 a gallon for the first time since April 12. Growth in gasoline supplies and the seasonal lull in demand are the major factors. A decision by OPEC+ last week to cut oil production temporarily sent crude oil prices higher but the increases were short lived and didn’t have a lasting impact on pump prices. For the week, the national average for regular ticks down two cents to $3.23 a gallon. The Oregon average loses five cents to $3.99.

“The Oregon average is finally below $4 a gallon. The last time it was below this threshold was on April 12. The national average is at its lowest price since January 3. Pump prices should continue to edge lower in the next couple weeks, barring unforeseen events,” says Marie Dodds, public affairs director for AAA Oregon/Idaho.

The national average for regular has been steadily falling since reaching its year-to-date high of $3.88 on September 18. The Oregon average has been moving lower since reaching its year-to-date high of $4.77 on August 30.

Twenty Oregon counties have averages below $4 a gallon:

Benton $3.69

Crook $3.94

Deschutes $3.88

Douglas $3.79

Gilliam $3.80

Hood River $3.73

Jackson $3.94

Jefferson $3.69

Klamath $3.89

Lane $3.73

Lincoln $3.49

Linn $3.67

Malheur $3.72

Marion $3.77

Morrow $3.67

Polk $3.79

Umatilla $3.73

Union $3.93

Wasco $3.84

Yamhill $3.88

OPEC+ (Organization of the Petroleum Exporting Countries and allies such as Russia) met last Thursday after postponing a meeting that had originally been scheduled for Nov. 26. The cartel announced additional oil production cuts, of 900,000 barrels a day, and Saudi Arabia said it would continue its cuts of a million barrels a day through March. Crude oil prices jumped last week ahead of the announcement, but then fell as concerns of decreasing global demand for oil sent prices lower.

Crude oil prices were volatile at the start of the conflict between Israel and Hamas in October. Fears that the conflict could escalate across the Middle East sent crude oil prices near $90 per barrel in October. Crude prices fell into the $70s on November 7 and have remained there since then. While Israel and the Palestinian territory are not oil producers, there’ve been concerns that the conflict could spread in the Middle East, which could impact crude production in other oil-producing nations in the region.

Crude oil prices tend to rise when there are geo-political events involving oil producers. Crude prices spiked after the invasion of Ukraine by Russia last year because Russia is one of the world’s top oil producers, behind the U.S. and Saudi Arabia. Crude prices also surge on news of production cuts by major oil producers. Crude oil prices spiked above $90 per barrel in mid-September, the highest price since last November, in response to the announcement from Saudi Arabia and Russia that they would keep their production cuts in place through 2023. The cuts are one million barrels a day by Saudi Arabia and 300,000 barrels a day by Russia.

Gas prices normally decline in the fall, in part due to a drop in demand for gasoline compared to the summer months and the switch from summer-blend gas to winter-blend gas. Winter-blend gas is cheaper to produce than summer-blend fuel as it contains ingredients such as butane, so gas prices normally fall when the switch occurs. Summer-blend gas helps reduce emissions from gasoline during the warm summer months. More info on summer- and winter-blend gasoline can be found at the EPA website. The switch occurs on September 15 except California, which normally keeps summer-blend gasoline until October 31. This year, California allowed the switch to occur earlier because of refinery issues in that state that sent pump prices soaring on the West Coast in late September.

Crude oil is trading around $74 today compared to $76 a week ago and $77 a year ago. So far this year, West Texas Intermediate has ranged between $63 and $94 per barrel. Crude reached recent highs of $123.70 on March 8, 2022, shortly after the Russian invasion of Ukraine, and $122.11 per barrel on June 8, 2022. The all-time high for WTI crude oil is $147.27 in July 2008.

Crude oil is the main ingredient in gasoline and diesel, so pump prices are impacted by crude prices on the global markets. On average, about 50% of what we pay for in a gallon of gasoline is for the price of crude oil, 25% is refining, 11% distribution and marketing, and 14% are taxes, according to the U.S. Energy Information Administration.

Demand for gas in the U.S. has decreased from 8.48 to 8.21 million b/d for the week ending November 24, according to the U.S. Energy Information Administration (EIA). This compares to 8.32 million b/d at the same time last year. Meanwhile, total domestic gasoline stocks increased by 1.8 million bbl to 218.2 million bbl.

Lower gas demand and growing gasoline stocks have helped put downward pressure on retail gas prices.

Quick stats

Oregon is one of 45 states and the District of Columbia with lower prices now than a week ago. Colorado (-13 cents has the biggest weekly drop. Georgia (+29 cents) has the biggest week-over-week increase.

California ($4.78) has the most expensive gas in the nation for the 19th week in a row. Hawaii ($4.71) is second, Washington ($4.32) is third, and Nevada ($4.10) is fourth. These are the four states with averages at or above $4, down from five states a week ago. This week 30 states and the District of Columbia have averages in the $3-range. Sixteen states have averages in the $2 range this week.

The cheapest gas in the nation is in Texas ($2.72) and Oklahoma ($2.74). No state has had an average below $2 a gallon since January 7, 2021, when Mississippi and Texas were below that threshold.

The difference between the most expensive and least expensive states is $2.07 this week, compared to $2.17 a week ago.

Oregon is one of 49 states and the District of Columbia with lower prices now than a month ago. The national average is 19 cents less and the Oregon average is 29 cents less than a month ago. Utah (-59 cents) has the largest monthly drop. Delaware (+1 cent) is the only state with a month-over-month increase.

Oregon is one of 47 states and the District of Columbia with lower prices now than a year ago. The national average is 17 cents less and the Oregon average is 23 cents less than a year ago. Utah (-73 cents) has the largest yearly decrease. Georgia (+11 cents has the largest yearly increase.

West Coast

The West Coast region continues to have the most expensive pump prices in the nation with six of the seven states in the top 10. It’s typical for the West Coast to have six or seven states in the top 10 as this region tends to consistently have fairly tight supplies, consuming about as much gasoline as is produced. In addition, this region is located relatively far from parts of the country where oil drilling, production and refining occurs, so transportation costs are higher. And environmental programs in this region add to the cost of production, storage and distribution.

| Rank | Region | Price on 12/5/23 |

| 1 | California | $4.78 |

| 2 | Hawaii | $4.71 |

| 3 | Washington | $4.32 |

| 4 | Nevada | $4.10 |

| 5 | Oregon | $3.99 |

| 6 | Alaska | $3.91 |

| 7 | Pennsylvania | $3.56 |

| 8 | Idaho | $3.54 |

| 9 | New York | $3.53 |

| 10 | District of Columbia | $3.46 |

As mentioned above, California has the most expensive gas in the country. Hawaii, Washington, Nevada, Oregon, and Alaska round out the top six. Arizona is 12th. Oregon is fifth most expensive for the seventh week in a row.

Like almost every other state in the nation, all states in the West Coast region are seeing week-over-week declines. California (-10 cents) has the largest weekly drop in the region. Nevada (-9 cents), Arizona (-8 cents), Washington (-6 cents), Oregon (-5 cents), Alaska (-4 cents), and Hawaii (-2 cents) are also seeing weekly declines.

The refinery utilization rate on the West Coast rose from 79.7% to 81.8% for the week ending November 24. This rate has ranged between about 73% to 96% in the last year. The latest national refinery utilization rate rose from 87.0% to 89.8%.

According to EIA’s latest weekly report, total gas stocks in the region climbed from 26.76 to 27.64 million bbl.

A higher refinery utilization rate and an increase in gasoline stocks can put downward pressure on pump prices.

Oil market dynamics

Crude oil prices rose last week ahead of the OPEC+ meeting and expectations that the cartel would make additional cuts in oil production. Although additional production cuts were announced, higher crude oil prices were not sustained on concerns of falling demand for crude oil around the world. Additionally, the EIA reported that total domestic commercial crude inventories increased by 1.6 million bbl to 449.7 million bbl last week.

At the close of Friday’s formal trading session, WTI fell $1.89 to settle at $74.07. At the close of Monday’s formal trading session, WTI lost $1.03 to settle at $73.04. Today crude is trading around $74 compared to $76 a week ago. Crude prices are about $7 lower than a year ago.

Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.

Diesel

For the week, the national average falls five cents to $4.18 a gallon. The record high is $5.816 set on June 19, 2022. The Oregon average loses six cents to $4.60. The record high is $6.47 set on July 3, 2022. A year ago the national average for diesel was $5.08 and the Oregon average was $5.30.

Find current fuel prices at GasPrices.AAA.com.

AAA news releases, high resolution images, broadcast-quality video, fact sheets and podcasts are available on the AAA NewsRoom at NewsRoom.AAA.com.

Find local news releases at https://oregon.aaa.com/community/media/media-contacts.html

Fuel prices are updated daily at AAA’s Daily Fuel Gauge at AAA Gas Prices. For more info go www.AAA.com. AAA Oregon/Idaho provides more than 890,000 members with travel, insurance, financial and automotive-related services, and is an affiliate of AAA National, serving more than 64 million motorists in North America.