Updated 3/14/2023

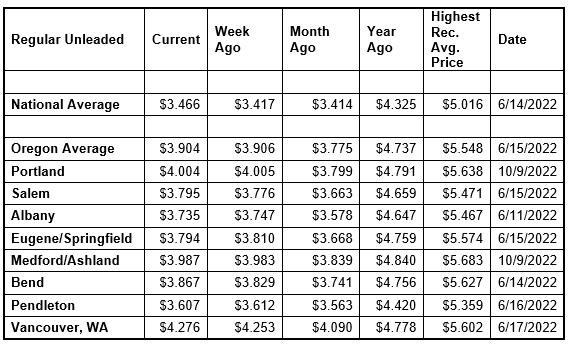

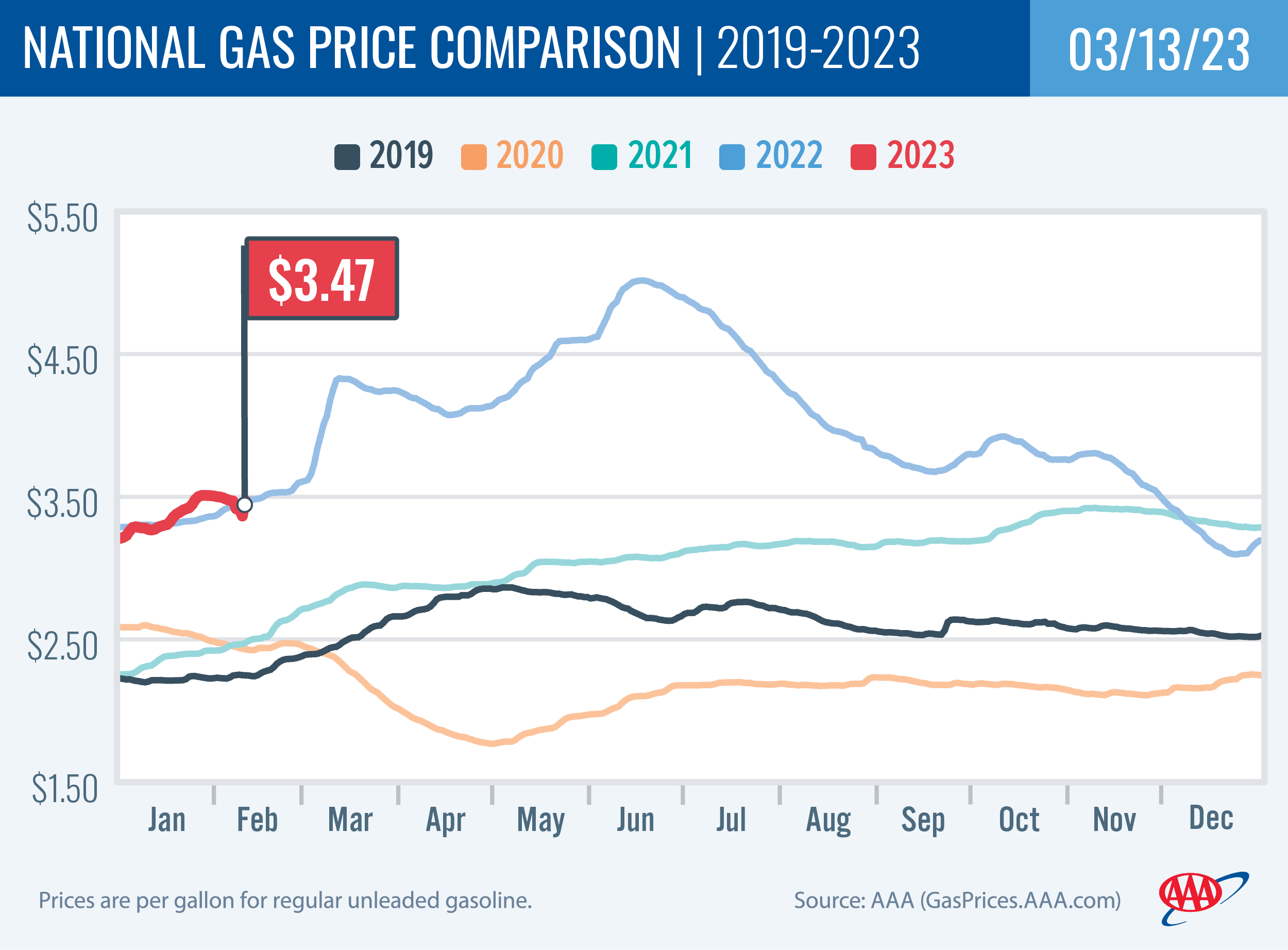

PORTLAND, Ore., – Gas prices continue their upward trek in many states as the annual switch to summer-blend fuel puts upward pressure on prices. However, the price pop could be winding down as demand and the global cost of crude oil have fallen. For the week, the national average for regular unleaded adds a nickel to $3.47 a gallon. The Oregon average holds steady at $3.90.

“The West Coast often sees the seasonal increases in gas prices earlier than other parts of the country because California has an April 1 deadline to switch to summer-blend fuel, while the federally mandated deadline is May 1,” says Marie Dodds, public affairs director for AAA Oregon/Idaho. “Less expensive crude oil and fewer people fueling up could help pump prices settle down.”

More info on summer- and winter-blend gasoline can be found at the EPA website.

Crude oil is trading around $73 today compared to $78 a week ago and $103 a year ago. In February, West Texas Intermediate ranged between about $73 and $80 per barrel. In January, WTI ranged between about $73 and $82 bbl. Crude reached recent highs of $123.70 on March 8, 2022, shortly after the Russian invasion of Ukraine, and $122.11 per barrel on June 8, 2022. The all-time high for WTI crude oil is $147.27 in July 2008.

Crude prices tend to increase in response to positive economic news, as growing, thriving economies tend to consume more oil. Crude prices also climb when geo-political events have the potential to disrupt supply. Crude prices rose dramatically leading up to and in the first few months of Russia’s invasion of Ukraine, and gas prices also skyrocketed. Russia is one of the world’s top oil producers and its involvement in a war causes market volatility, and sanctions imposed on Russia by the U.S. and other western nations resulted in tighter global oil supplies. Oil supplies were already tight around the world as demand for oil increased as pandemic restrictions eased.

Crude oil is the main ingredient in gasoline and diesel, so pump prices are impacted by crude prices on the global markets. On average, about 56% of what we pay for in a gallon of gasoline is for the price of crude oil, 20% is refining, 11% distribution and marketing, and 14% are taxes, according to the U.S. Energy Information Administration.

Demand for gasoline in the U.S. declined from 9.11 million to 8.56 million b/d for the week ending March 3. This compares to 8.96 million b/d a year ago. Meanwhile, total domestic gasoline stocks decreased by 1.1 million bbl to 238.1 million bbl last week. Although gas demand has declined, fluctuating oil prices have increased pump prices amid tighter supply.

Quick stats

Oregon is one of 16 states where the price has changed by less than a penny week-over-week. Arizona (+20 cents) and New Mexico (+13 cents) have the largest gains. Colorado (-9 cents) and Indiana (-6 cents) have the largest weekly declines.

California ($4.91) has the most expensive gas in the nation for the second week in a row. Hawaii ($4.85) is second, Nevada ($4.33) is third, and Washington ($4.25) is fourth. These are the only four states with averages at or above $4 a gallon. This week 46 states and the District of Columbia have averages in the $3-range. No states have averages in the $2-range this week, compared to two states a week ago.

The cheapest gas in the nation is in Mississippi ($3.01) and Oklahoma ($3.04). For the 113th week in a row, no state has an average below $2 a gallon.

The difference between the most expensive and least expensive states is $1.89 this week compared to $1.95 last week.

Oregon is one of 25 states with higher prices now than a month ago. The national average is five cents more and the Oregon average is 11 cents more than a month ago. This is the 10th-largest monthly increase in the country. Arizona (+50 cents) and California (+27 cents) have the largest monthly gains. Massachusetts (-10 cents) and Pennsylvania (-9 cents) have the largest monthly declines.

All 50 states and the District of Columbia have lower prices now than a year ago. The national average is 86 cents less and the Oregon average is 83 cents less than a year ago. Connecticut (-$1.15) and Massachusetts (-$1.06) have the largest yearly drops. A year ago, pump prices were rising rapidly after the start of the Russian invasion of Ukraine.

West Coast

The West Coast region continues to have the most expensive pump prices in the nation with all seven states in the top 10. It’s typical for the West Coast to have six or seven states in the top 10 as this region tends to consistently have fairly tight supplies, consuming about as much gasoline as is produced. In addition, this region is located relatively far from parts of the country where oil drilling, production and refining occurs, so transportation costs are higher. And environmental programs in this region add to the cost of production, storage and distribution.

| Rank | Region | Price on 3/14/23 | ||

| 1 | California | $4.91 | ||

| 2 | Hawaii | $4.85 | ||

| 3 | Nevada | $4.33 | ||

| 4 | Washington | $4.25 | ||

| 5 | Arizona | $3.95 | ||

| 6 | Oregon | $3.90 | ||

| 7 | Colorado | $3.89 | ||

| 8 | Utah | $3.85 | ||

| 9 | Alaska | $3.82 | ||

| 10 | Idaho | $3.67 |

As mentioned above, California has the most expensive gas in the nation for the second week in a row. Hawaii Nevada, Washington, Arizona, and Oregon round out the top six. Alaska is ninth. Oregon is sixth for the fifth week in a row.

Arizona (+20 cents) has the largest jump in the country and the region. All the other six states in the West Coast region are seeing small price changes of a penny or less this week.

The refinery utilization rate on the West Coast rose 77.8% to 78.3% for the week ending March 3. This rate has ranged between about 73% to 93% in the last year. The latest national refinery utilization rate is 86.0%.

According to EIA’s latest weekly report, total gas stocks in the region increased from 30.42 million bbl. to 30.94 million bbl.

A higher refinery utilization rate and an increase in gasoline stocks help put downward pressure on pump prices.

Oil market dynamics

Crude prices declined last week due to weaker domestic oil demand expectations for 2023 after the Chair of the U.S. Federal Reserve indicated that additional interest rate increases are likely. The market is concerned that rising interest rates could tip the U.S. economy into a recession, which would lower oil demand amid reduced economic activity. Additionally, the EIA reported that total domestic commercial crude inventories decreased by 1.7 million bbl to 478.5 million bbl last week.

At the close of Friday’s formal trading session, WTI gained 96 cents to settle at $76.68. At the close of Monday’s formal trading session, WTI fell $1.88 to close at $74.80. Today crude is trading around $73, compared to $78 a week ago. Crude prices are about $35 less than a year ago.

Drivers can find current gas prices along their route with the free AAA Mobile app for iPhone, iPad and Android. The app can also be used to map a route, find discounts, book a hotel and access AAA roadside assistance. Learn more at AAA.com/mobile.

Diesel

For the week, the national average falls four cents to $4.34 a gallon. The record high is $5.816 set on June 19, 2022. The Oregon average slips a penny to $4.71. The record high is $6.47 set on July 3, 2022. A year ago the national average for diesel was $5.13 and the Oregon average was $5.37.

Find current fuel prices at GasPrices.AAA.com.

AAA news releases, high resolution images, broadcast-quality video, fact sheets and podcasts are available on the AAA NewsRoom at NewsRoom.AAA.com.

Find local news releases at https://oregon.aaa.com/community/media/media-contacts.html