Inexpensive crude oil, busy refineries and abundant fuel supply fend off record demand

BOISE – (August 22, 2019) – It’s been a summer punctuated by record holiday travel and skyrocketing fuel demand, but most Americans wouldn’t know it just by visiting their local gas station. In what AAA Idaho calls a “perfect storm,” inexpensive crude oil, highly productive refineries and abundant gasoline stocks have combined to keep gas prices down.

Millions more Americans were on the road for Memorial Day and Independence Day this year, and for the week ending August 9, the Energy Information Administration recorded U.S. fuel demand at just under 10 million barrels per day, the highest level since the agency began tracking data in 1991. But so far this summer, none of that appears to matter.

“Surprisingly, the summer surge in gas prices was over before it started,” says AAA Idaho public affairs director Matthew Conde. “Idaho is a very busy place in the summertime, as tourists and residents take advantage of the warm weather to embark on a series of road trips across our state. This year has been no exception, but we’ve also had nearly three consecutive months of falling gas prices – something we’re much more likely to see after Labor Day, not before.”

Today, the U.S. average gas price is $2.60, which is 17 cents less than a month ago and 23 cents less than a year ago. In the Gem State, the average price for regular gasoline is $2.83, which is 9 cents less than a month ago and 42 cents less than a year ago. Idaho gas prices are typically among the most expensive in the nation (currently 8th for most expensive fuel), in part because the West Coast and Rockies regions have less competition, more population migration, and fewer refinery additions than other parts of the country.

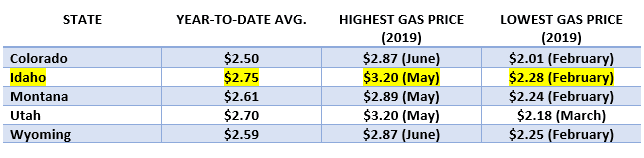

Here’s a brief comparison of 2019 gas prices in the Rockies region:

Although pump prices could level off or even increase slightly for Labor Day travel, AAA predicts that Idaho gas prices could drop by as much as 15 to 20 cents before Thanksgiving, due to decreased demand and the switch to cheaper-to-produce winter-blend fuel.

AAA says that three factors are primarily responsible for this year’s summer savings:

Inexpensive crude oil

The West Texas Intermediate benchmark for crude oil has hovered between $50 and $60 per barrel for most of the summer, and AAA expects the trend to continue throughout the fall. Last year, prices ranged between $60 and $75 per barrel.

“Industry experts continue to believe that the global crude market is oversupplied. Meanwhile, trade disputes between the United States and China could reduce the amount of oil consumed by both countries,” Conde said. “Our domestic crude inventories currently sit at 438.9 million barrels, which is 32 million barrels higher than this time last year. For motorists, that’s a good sign – about half of the cost of a gallon of gas is tied to the price of oil, so the more oil there is, the better.”

Productive regional refineries

Since Memorial Day, refineries in the Rockies region have maintained an average utilization rate of 100 percent, sometimes topping out at 103 percent in recent weeks. Thanks to their peak performance, fuel supplies were replaced as fast as they were consumed throughout the summer.

Although refineries will reduce their utilization rates to perform seasonal maintenance during the switch to winter-blend fuel, a corresponding drop in demand should prevent gas prices from rising.

Abundant fuel supply

The Rockies region can store 7.5 million barrels of refined gasoline; that’s the smallest amount by region in the country. But because refineries kept pace with the strong demand, gasoline stocks stayed above 7 million bbl (a one-million-barrel surplus over last year) throughout the summer.

“When there’s plenty of pressure coming from the demand side, a lot of things have to go right on the supply side to keep prices down,” Conde said. “This year, we’ve been very fortunate.”

What’s next?

Several things could alter the course of gas prices this fall and winter. OPEC (Organization of the Petroleum Exporting Countries) will meet in December to discuss ongoing crude oil production cuts. If they elect to increase those cuts, it could impact crude oil and gas prices heading into 2020.

The National Oceanic and Atmospheric Administration predicts this year’s hurricane season to be busier than normal, with 10 to 17 named storms and five to nine hurricanes. Just the threat of a hurricane making landfall in sensitive areas can shut down refineries and cause prices to spike.

The International Maritime Organization is cutting sulfur in fuel oil as part of its new standards for large ships. Some fuel products may be pulled out of the system for maritime use instead of being further refined for use in automobiles, which may shrink gasoline stocks in coastal regions.