BOISE – It’s the most wonderful time of the year, a magical season for presents large and small. Automobile commercials frequently promote special offers on beautiful new cars, many with a large bow attached. But how much does a new car really cost?

Every year, AAA publishes the Your Driving Costs report to help consumers make an informed purchase decision. Prospective vehicle owners need to consider the full implications of buying a new car, not just the sticker price.

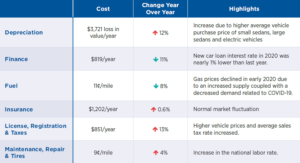

“If you’re in the market for a new vehicle this year, there’s good news and bad news,” says AAA Idaho spokesman Matthew Conde. “Financing rates are pretty competitive right now, and gas prices are much cheaper than a year ago. But depreciation comes into play the minute you leave the lot, and it’s also getting more expensive to insure, register, and maintain a new vehicle, because many are equipped with advanced systems that cost more to repair and replace.”

The average cost to own and operate a new car for one year is $9,561 – $279 higher than last year. Pickup trucks are the most expensive to own at an estimated 75 cents per mile, followed by large sedans and minivans. With lower insurance premiums and better fuel economy, small sedans carry the lowest overall driving costs at 50 cents per mile.

For AAA’s study, the costs of vehicle ownership are calculated for five top-selling models in each of nine vehicle types, which are then averaged over five years and 75,000 miles.

“Our hope is that sharing this information helps Idahoans budget for the car they want without any unpleasant surprises,” Conde explained. “In some cases, it may make sense to scale back and get a quality vehicle that’s more affordable.”

Tips for buying a car

- Do your homework. Does your dream car require premium fuel or an expensive motor oil? How much will it cost to re-align sensors or cameras if needed? What are other owners saying online? How much more will it cost to insure?

- Shop for competitive financing. New car loan interest rates are nearly 1% lower than last year. Ask the dealer, your bank, and your insurance company about financing options. Consider adding coverage to offset any gap between insurance payouts and the balance due on the loan if the vehicle were to be totaled in a collision.

- Go with a pre-owned vehicle. If you don’t need the latest technology, you’re likely to save on the cost of maintenance, insurance, and registration fees.

AAA has published the annual Your Driving Costs report since 1950.